The World Without Lies

Political and economic commentaries.

Thursday, 8 November 2012

Stephen Fry, a mass murder apologist?

Stephen Fry on Qi:

[Stephen Fry] "What do the Icelandic Eyjafjallajökull volcano eruption and Genghis Khan have in common?

The odd thing is that it's both very beneficial, especially at the moment we talk about a lot.

Now, that volcano poured out, they recon, between 150 thousands 300 thousands tons of carbon dioxide, so huge amount of carbon came out as a result of it. But, if you remember, no one flew for how ever long it was, and the lack of flying saved 3 million tons. So in fact, it was a huge offset of carbon.

And in case of Genghis Khan, he slaughtered his way across the world, he had the largest empire the world has ever seen, 4 times bigger than that of Alexander, twice the size of the Roman empire, and he killed about 40 million people, and the result was there was so little farming, forest grew back, and you could time a huge benefit to the world from his slaughter.

But that's rather extraordinary, isn't?"

Please see the link to the video here.

What is rather extraordinary is that such radical statements praising mass murder goes unnoticed in polite society.

It should be shocking to anyone who has any kind of empathy to human suffering, that claiming that 40 million deaths constitute a "huge benefit to the world" is something monstrous to say.

Countless of men, women, children, orphans starving to death on the side of their their slaughtered parents, this is apparently worth to Mr Fry the benefit of some trees growing back and weed taking over abandoned farms.

I have another riddle for Mr Fry:

What do George Bernard Shaw and Stephen Fry have in common?

They both believe that mass murder is something beneficial for the world.

Through history, there always existed intelligent people who were blindly in love with their own ideologies, that they justified killing innocent people in order to achieve their Utopian world.

The Hiltlerian regime didn't come out of nowhere with the idea of eliminating "social parasites", it was ideas explicitly supported by intellectuals like George Bernard Shaw who morally justified and made possible the mass murder of innocent people.

As the common saying goes, we must be careful of what we wish, because it might very well happen.

I call upon Mr Fry to retract his words, and publicly apologize for giving voice such cruel and appalling ideology, which state that humans death is a benefit to the world.

Tuesday, 14 September 2010

Top 10 Myths about Economics

The ideas commonly held about economics originate often from superstition, ignorance, bias against foreigners or strangers, but more often from plain propaganda, where one group of people want to promote its interest by spreading disinformation.

I collected the following list of economic myths, and a short rebuttal:

10. Economic growth means people have more money

No. Economic growth means that people are more productive, and produce more goods using less resources (mostly labor time).

Economic growth causes a general fall in prices, as when there are more goods relative to the money supply, the ration of units of money over units of goods is lower.

For example, the computer hardware industry has been growing tremendously over the last 30 years, along with a steady fall in the price of computers and peripherals.

What people typically mistake as economic growth are in fact artificial booms created by the creation of money (“easy money policies”) of the central bank, which causes artificial profits and speculative bubbles, that later collapse once the source of the boom is withheld.

9. The economy can “overheat” when growth is too high

By “overheating”, most economic commentators means “prices are increasing faster”.

Once again, this is not the effect of economic growth – which causes general prices to fall – but of an artificial speculative bubble caused by an expansion of credit directed by the central bank.

Once the new money created by the central bank percolates through the economy, it eventually makes prices rise (more money leads to less goods per money unit, which leads to higher money per good ratio, i.e. higher prices).

This is not a phenomenon of the free market, but of government manipulation of the financial market.

8. Free trade is shipping jobs abroad

Free trade is always bi-directional, otherwise it would be called “foreign aid”.

Therefore, when, say, an American buys a good from China, paying in US dollars, the Chinese seller ultimately gets paid back in exchange by buying a US good.

This US good can be either a consumer good (such as a trip to DisneyLand), or a capital good (such as heavy machinery), or a financial asset (such as government debt securities).

What is typically reported in the press about the current account deficit is typically reporting only trades of tangible goods, without reporting trades of services or financial assets (which is recorded in the capital account).

So this means that when foreign investors invest in mass in the US, this causes a capital account surplus, and a current account deficit – which makes good headlines for the press, but a misleading understanding of international trade.

Free trade does not destroy jobs, but reallocate jobs in a given country from relatively less competitive to relatively more competitive sectors.

Preventing free trade impoverish both population of country, while free trade promotes peace, cooperation, and improvement in living standards.

7. Without the minimum wage, people would earn below subsistence wage

The vast majority of US workers in the private sector earn more than the minimum wage.

Also, many western countries do not even have minimum wage laws (Switzerland, Germany, Italy, Austria, Norway, Sweden, Norway, Denmark, etc…) , but their workforce still enjoy relatively high wages.

The force that drives the price of labor up in the free market is competition by employers, and capital investment which increase workers productivity.

Minimum wage laws in fact makes illegal for poor and low skilled people (especially young workers) from being employed at all.

This deprived those workers of the much needed “step in the door” in the labor market, which would allow them to gain experience and increase their productivity and their wage.

For example, young black males unemployment rates in the US were the same as white males in the 1940s before minimum wage laws existed. From 1890 through 1930, every survey showed that black men had the same participation rate in the labor market, if not higher, than white men. But since minimum wage laws were instituted, young black male unemployment soared, reaching 35% today, 20 points above other ethnicities.

Worker’s Unions typically lobby politicians for higher minimum wage laws in an effort to eliminate their direct competitors (lower skilled workers) and increase their own wages at the expense of poor people.

6. Government spending helps the economy

One thing that is true, is that government spending helps GDP statistics looks better, since the government spending is counted as a direct contributor, on par with private spending.

However, this is an obvious flaw in the GDP statistics accounting, rather than a reflection on the real contribution of the government spending on the amount of goods produced in the economy.

Basically, the problem is that we can’t consider on the same level goods that are produced and paid for voluntarily by consumers, and services paid by the government with money taken from taxes.

For example, if a private citizen decides to spend 100$ on tickets for a trip to Disneyland, this tells something about the value of the service produced by the Disney Corporation in operating the attraction park.

That a bureaucrat decides to spend someone else’s money (the tax payer), to the extent of 389,357$ on a study of whether malt liquor should be used with or without marijuana says very little about the value of the service produced to society.

Government spending also does not help the economy in general, as soon as one consider the source of government spending – if someone claims that the government spending has “multiplier effect” in the economy (as do many economist trained as propagandist for the government), then when one realize that money spent by the government has first to be taken from producers in the private sector (either through taxes, inflation, or borrowing), this confiscation must also have a “divider effect” – which is not surprisingly never discussed when we hear about the alleged benefits of government stimulus spending.

In other words, if the government spends 100$, and those receiving it in turns spends it, and so on, then the persons that were taxed had also 100$ less to spend other other goods in the private sector, and so are the people who would have received the 100$, and so on.

And since government spending is worth much less, as we seen above, government spending is actual destroying wealth in the society.

An argument that I am not addressing here is the alleged ‘fall in aggregate demand’, which completely ignores the existence of prices.

5. We are better off today than 100 years ago because of technology

Technology (the knowledge of how natural resources can be transformed to satisfy ends) isn’t sufficient into producing the means to satisfy those ends.

For instance, the ancient Greeks had discovered the steam engine, yet it did not foster economic development as it did at the beginning of the industrial revolution.

Sub-Saharan Africa has access to all the knowledge and technology that the west uses, alas it remains poor.

This is because the knowledge isn’t enough, what is needed is the capital goods that make use of that knowledge. Without saving, it is not possible to accumulate capital goods, and without capital the population is reduced to use unproductive means of production.

Today, we are better off in the west because we have more goods, because we are more productive, thanks to the capital accumulation and the saving of the previous generations over decades and centuries.

As Ludwig von Mises explain, the essential institutional requirements for saving and capital accumulation are: liberty, private property, and sound money.

4. Poor countries are poor because they don’t have money

Poor countries are poor, mainly because their citizen are less productive than the citizen of western countries.

They are less productive because they use much less capital goods. For instance, the farmers in Africa do not use modern agricultural techniques, using tractors, fertilizers, and so on, because they lack the savings required to buy those capital goods, or because those capital goods are typically expropriated or destroyed before they can be put to profitable use.

Many poor countries have dysfunctional capital formation mainly because of lack of 1) private property rights 2) liberty to use one’s property, and 3) sound money.

Poor countries are plagued by governments that routinely violates their citizen’s property rights, through taxes, licenses, permits, tariffs, regulations, and outright expropriation, so that saving and investment is a futile exercise since the savings do not benefit the person abstaining from consuming his own income.

In fact, government that issue the most money typically impoverish their population the most (everyone is a billionaire in Zimbabwe).

3. High prices are caused by greedy businessmen

In spite of the desire from greedy businessmen to maximize their profit, competition on the free market by entrepreneurs leads to higher capital investment, higher productivity, higher production, and generally lower prices.

The ultimate cause of the increase in prices is the deliberate devaluation of the currencies, year after year, by increasing the quantity of money in the economy by the central bank.

In the US, for example, the quantity of money (M2) went from roughly 300 billions in 1960 to 8500 billions in 2009, while the value of the US dollar lost 86% of its purchasing power over the same period.

In other words, 100 dollar saved in 1960 will today only buy 14$ of goods – 86$ having been expropriated through the devaluation of the currency.

2. For someone to get rich, others have to get poor

It is true that, given a fixed stock of money, one cannot increase his cash holding without someone else having to reduce his own.

The major caveat being that money is not wealth in the aggregate sense, meaning that even though one person becomes wealthier by having a larger cash holding, all other things equal, having more money in the economy does not generate more wealth, it simply reduces the value of the existing money stock.

Fortunately there is many other ways of being wealthy, one being by owning capital goods.

For example, the stock of money can remain constant over time in a village, but if a farmer plough his land, accumulate live stock, dig a new well (i.e. he refrain from consuming all his income, and instead invest parts of it in improvement of his capital stock), he becomes wealthier without other villagers to having to get poor.

In fact, by being able to produce more agricultural goods, and exchanging them to the other villagers, the farmer makes everyone wealthier.

The same is true for modern entrepreneurs, as long as they operate strictly on the free market, and do not use privileges by the governments (subsidies, government contracts, tariffs, patents, licenses, grants, eminent domain benefits, regulations, etc..) to enrich themselves at the expense of others.

1. War, disasters and destruction cause economic prosperity

This is the classic broken window fallacy.

This idea claims that by destroying goods, the activity required to replace those goods will improve the conditions of everyone in the economy by promoting the circulation of money.

It goes without saying that the purpose of producing goods in the first place is to enjoy the services of the goods produced by this process. Toiling to produce goods is not something anyone wants to do for its own sake, and destroying the produced good simply to suffer the disutility of having to produce them again is nonsensical.

The problem arise when the production process is divided between different persons through the division of labor and voluntary exchange (the exchange economy). Once someone produces goods not for his own consumption but for someone else's, the problem for the producer of deciding which goods to produce that will satisfy other people’s needs arises, which didn’t exist when a single person was producing goods for his own consumption.

Basically, in an exchange economy, some people (called entrepreneurs) will take upon themselves to discover which goods should be produced, and coordinate the producers desire for an income, with the consumers spending intentions for those goods, through competition and the price system.

This is a task of coordination that will always exist in all economic organizations where there is a division of labor.

The fundamental error in the broken window fallacy is to completely ignore this coordination task, and assume that the glazier’s (see the link above) desire for an income can only be satisfied by destroying existing windows, since not enough demand exist without it for all the glaziers in the town.

In fact, the glazier would have to realize that demand for window repair services are satiated, and that his task is to discover (since he is small business owner, hence an entrepreneur) which goods consumers would like to be produced, so that he can reallocate his labor to the production of those goods, if he wants to remain involved in the exchange economy.

It is obvious then that the fallacy of destruction is a naïve attempt to find which goods needs to be produced: "If a good exist already, then it must be because there was a demand for it, so instead of discovering which goods needs to be produced, we can only destroy the existing goods, and the coordination problem will be resolved”. Needless to say, this solved the problem for the coordinator only, at the expense of the owner of the good.

As long as humans have needs that are not fully satisfied, and the freedom to satisfy those needs exist, employment through the division of labor will be possible.

If we ever reach the Garden of Eden, where all human needs are fulfilled, then we will not be able to find employment in the division of labor, but then we wouldn’t need a job nor an income either, since all our needs will be satisfied.

The fundamental truism remains that destruction destroys wealth, and makes the economy poorer than it would be otherwise. Destroying capital goods also makes the economy less productive, so is allocating capital goods to the production of goods that have been needlessly destroyed.

It is an indisputable fact that without the destruction having ever happen, the society would have been richer than it would be by re-producing destroyed goods.

That destruction causes prosperity is an old fallacy (Resurrected in modern times by J.M. Keynes), that originates from the ignorance of one fundamental insight of economics science (from Hazlitt):

To see the problem as a whole, and not in fragments: that is the goal of economic science

Understandably, most person reading this list will be unconvinced by few or many of the short description attempting to dispel the myths. Many “yes, but…” “you haven’t tough of…” and “this is wrong because…” should be heard in the average reader’s mind.

There is simply not enough space in a short blog post to give a comprehensive economics lesson.

If this list made your curious about learning more, a good start would be this book:

Also available for free online here.

Loch Ness picture from user Carla216 on Flicker, creative commons.

Friday, 27 August 2010

The Dow Jones still hasn’t recovered from…the Great Depression.

Almost all financial advisers, when discussing about gold as an investment, will not fail to mention its infamous price in January 1980 of 800$ / oz, and how adjusted for inflation today, it would be a lousy investment.

The problem is that these comments underlines the lack of rigor of the commentators by cherry picking a price that existed only for a few days 30 years ago.

By the same measure, are financial advisers always mentioning to their clients when buying stocks that the DOJ still hasn’t recovered from the Great Depression of 1929?

Indeed, since in October 30th 1929, the DJI hit 380.33.

In these days, $20.60 was defined as 1oz of gold (the US was more or less under the classical gold standard). So that meant that the 20$ bills were redeemable at the US treasury for a 20$ gold coin containing .96750 troy oz of pure gold (20$ / 0.96750 oz happens to equate 20.6 $/oz).

So the DJI was worth 18.5 oz of gold.

Fast forward 80 years, the DJI is today (August 27th 2010) at 10078, which is worth (gold spot being currently 1241$/oz) … 8.1 oz of gold, which means $167.28 in 1929 dollars.

Basically, using the same unit of money that existed in 1929, the Dow Jones industrial index is worth today less than half (167 vs. 380) of what it was 80 years ago.

In fact, in the graph above, we can see the variation of the DJI in terms of gold over the years (source: finance.yahoo.com, world gold council).

Note that the raise of the DJ/gold ratio in the 1960’s is mainly caused by the artificial pegging of the price of gold by the US government at 35$/oz, while the run up in the 1990’s is partially caused by the mass selling and lending of bullion by American and European central banks.

Moral of this story? By cherry picking dates, we can portrait an investment class in any light we want.

But financial advisers, who often are also stock brokers, or work for stock brokerage firms, align their advice with their interests, and recommend investment vehicles that fill their own pockets first.

Tuesday, 6 July 2010

Khan Academy: Teaching falsehoods to 200 000 kids a month?

I read recently about the Khan Academy.

This academy consist of a person recording hundreds of youtube videos teaching different subjects, going from mathematics, chemistry, biology, history, and economics.

The teachings are short, 10 minute videos, targeted at explaining to the student and dilettante many scientific subjects.

Allegedly, up to 200 000 students are visiting the site each month.

I didn’t watch the other themes, and I assume they are fine, but the ones about economics are terribly bad.

It is doubtful if Mr. Khan even had a micro-economics class (since you don’t hear him talk about supply and demand basics), but it seems typical of the learned intellectual who seem to think that because he knows some scientific subject, he can just “think” about economics in his head, without learning systematically about the subject, and whatever seem to be “common sense” to him must be true.

For instance, for Mr. Khan, what causes inflation is (typical scapegoats) businessmen raising their prices. Why do businessmen raise their prices, according to Mr. Khan? Simply because they can, when there’s high utilization of the factors of productions (e.g, a factory producing at half capacity).

The fact that the US dollar lost 96% of its purchasing power over the last century is apparently simply due to greedy businessmen.

Not surprisingly, Mr Khan has no notion of money supply (money is simply a “unit”).

Mr. Khan analysis is one that statically look a a single company, or a set of a handful of companies, in a given year, and speculates (badly) on their hypothetical behavior without having any clue about what forces will lead to prices change in equilibrium.

Mr. Khan needs to read an introductory book (as this one, for example) about money, and learn that it is not businessmen that cause the general price level to rise, but the Federal Reserve that increase the money supply, year after year, and destroy the purchasing power of the monetary unit.

In fact, the truth is the opposite – businessmen, by their capital investment, cause an increase in productivity, which leads to higher production, and lower prices in general.

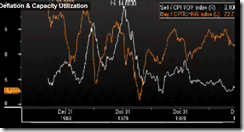

What does Mr. Khan shows as evidence of his theory? The following graph:

(sorry for the bad resolution, taken from his video)

The “capacity utilization” (I’m not sure what metric he uses) is in orange, while the price index is in white;.

Mr Khan pretends that the former (the capacity utilization) is cause of the later (the price index). So when one rises (capacity utilization), the other should raise as well (price index).

If there’s any example of confirmation bias, that is one.

At best, that graph shows that there’s no correlation between the two metrics (for some years, they raise in parallel, while other years, one raise while the other falls).

For the entire decade after 1990, prices fall while capacity utilization increases.

Worse, the graph fundamentally contradict Mr. Khan’s arguments, which is that “high capacity utilization” causes prices to rise, and low utilization causes prices to fall. Indeed, his graph shows the CPI change rate, which is the rate at which prices increase, not the price level itself.

Basically, his graph shows that the price level increase year after year, no matter is the capacity utilization is high or low. The price level never decrease for all the decades presented (the CPI change rate never go below 0%). So it doesn’t explain why prices increase at all, since they increase no matter what is the capacity utilization – and the rate doesn’t even correlate with the capacity utilization.

So in fact, this graph is the very refutation of his own argument.

Then, Mr. Khan even goes on to say that he was worried about hyperinflation because capacity utilization was getting too high at the end of last decade.

Why do Mr. Khan “common sense” fails? Because he incorrectly extrapolate from his single analysis of an isolated business (which is far from accurate) to the general economy: the fallacy of composition.

Mr. Khan does not explain why would capacity utilization fluctuate at large in the economy, how it could become “uncontrollably high” as to generate hyperinflation, nor why isn’t high capacity utilization naturally counterbalanced by increase in investment, rising of the interest rate, and decrease in consumption.

Nor, why would cycles of high and low “capacity utilization” would cause a sustained increase in prices? Why wouldn’t the prices go high and low, and overall remain stable over time?

Why would not the general increase in productivity over the years, and general increase in production cause a general fall in prices instead (more supply –> lower prices)?

Just basic econ 101 questions that Mr. Khan fails even to consider.

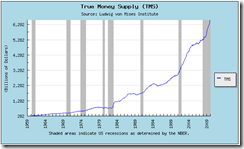

Maybe Mr. Khan should look at this graph instead, and he will maybe start to understand the main reason why prices increase, year after year:

http://mises.org/content/nofed/chart.aspx?series=TMS

Unfortunately, this is not all of Mr Khan’s pitfalls.

In Mr. Khan example, businessmen simply go purchasing luxury cars at the first sight of profit. The only thing they control is the asking prices of their goods, and ask high as they can mange to get. They are not investors, but behaves like spendthrift customers.

Mr Khan also shows the typically intellectual anti-business mentality, where in his example, for a company to be successful, they must deceive customers (by putting nicotine in their cupcakes) and gouge them arbitrarily (“increase prices when utilization is high”).

The problem is that, like most intellectuals, Mr. Khan would be a terrible businessman, who would go quickly out of business against better competitor if he was to behave as he portraits businessmen to behave in his examples.

Businessmen are not moron who can only tinker with prices (those who are are not in business for long) to maximize their profit rate. What they want is maximize their profit, no matter what is the rate they will have (better to have 10% on 2 millions $ than 50% on 50k $), and by forecasting their customers and competitors behaviors, they invest, expand, change, innovate accordingly.

In conclusion, that Mr. Khan is economically illiterate is not a problem, but that he remains in this state of ignorance and go teach students about his ideas is a danger to the progress of knowledge and the general welfare of society.

Saturday, 20 February 2010

Off Topic: OWC Mercury Extreme Enterprise Class SSD

- Over 250 MB/s read and write performance (on a Mac Pro).

- Sizes from 50GB to 200GB (from 229$ to 779$)

- 10 million hours Mean Time Before Failure (compared to 1.2 million for the Intel X25-M)

- 5 years guarantee

- Advanced Wear Level Management, so that the performance won't degrade over time even without using the TRIM feature (critical for Mac OS X users, since Apple is yet to support it in its operating system).

Wednesday, 6 January 2010

Democracy: The God That Failed - On Discrimination

Thinking about discrimination as discussed in Hoppe's work, "Democracy: The God That Failed", I came to the following:

The nature of discrimination (i.e. excluding someone from using one's property, of refusing to do accept an exchange with someone), while of course being a prerogative of private property as argues Hoppe, is different whether the property is a consumption good or a capital good.

For consumption goods, discrimination is essentially a characteristic related to the subjective preferences of the consumer, whether he likes cold tea, and discriminates against hot tea, or he wants to live in a neighborhood with Germans, Catholics, or not.

This is essentially the discrimination that Hoppe is referring to.

But most goods and exchange in an advanced market economy are not consumer goods, but capital goods, or goods of higher order.

As such, the discrimination being performed by the capital good owner is targeted towards its role in contributing to the production of the final the consumer good.

A factory owner, for example, will discriminate against drunk employees in his factory, while discriminating against, say, homosexuals, makes no sense whatsoever

My point is that Hoppe overlooks completely the discrimination in capital good industries (or rather the lack thereof against "Germans, Catholics, homosexuals", or anything not related to the actual production of the final consumer good), which is a powerful forces towards promoting tolerance and peaceful cooperation between people of different cultures, opinions, etc...

Being intolerant of other people has a steep price in a free society, and Hoppe's assessment of the natural order based radical segregation of "counter cultural" individuals is incorrect.