The ideas commonly held about economics originate often from superstition, ignorance, bias against foreigners or strangers, but more often from plain propaganda, where one group of people want to promote its interest by spreading disinformation.

I collected the following list of economic myths, and a short rebuttal:

10. Economic growth means people have more money

No. Economic growth means that people are more productive, and produce more goods using less resources (mostly labor time).

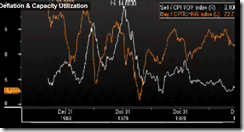

Economic growth causes a general fall in prices, as when there are more goods relative to the money supply, the ration of units of money over units of goods is lower.

For example, the computer hardware industry has been growing tremendously over the last 30 years, along with a steady fall in the price of computers and peripherals.

What people typically mistake as economic growth are in fact artificial booms created by the creation of money (“easy money policies”) of the central bank, which causes artificial profits and speculative bubbles, that later collapse once the source of the boom is withheld.

9. The economy can “overheat” when growth is too high

By “overheating”, most economic commentators means “prices are increasing faster”.

Once again, this is not the effect of economic growth – which causes general prices to fall – but of an artificial speculative bubble caused by an expansion of credit directed by the central bank.

Once the new money created by the central bank percolates through the economy, it eventually makes prices rise (more money leads to less goods per money unit, which leads to higher money per good ratio, i.e. higher prices).

This is not a phenomenon of the free market, but of government manipulation of the financial market.

8. Free trade is shipping jobs abroad

Free trade is always bi-directional, otherwise it would be called “foreign aid”.

Therefore, when, say, an American buys a good from China, paying in US dollars, the Chinese seller ultimately gets paid back in exchange by buying a US good.

This US good can be either a consumer good (such as a trip to DisneyLand), or a capital good (such as heavy machinery), or a financial asset (such as government debt securities).

What is typically reported in the press about the current account deficit is typically reporting only trades of tangible goods, without reporting trades of services or financial assets (which is recorded in the capital account).

So this means that when foreign investors invest in mass in the US, this causes a capital account surplus, and a current account deficit – which makes good headlines for the press, but a misleading understanding of international trade.

Free trade does not destroy jobs, but reallocate jobs in a given country from relatively less competitive to relatively more competitive sectors.

Preventing free trade impoverish both population of country, while free trade promotes peace, cooperation, and improvement in living standards.

7. Without the minimum wage, people would earn below subsistence wage

The vast majority of US workers in the private sector earn more than the minimum wage.

Also, many western countries do not even have minimum wage laws (Switzerland, Germany, Italy, Austria, Norway, Sweden, Norway, Denmark, etc…) , but their workforce still enjoy relatively high wages.

The force that drives the price of labor up in the free market is competition by employers, and capital investment which increase workers productivity.

Minimum wage laws in fact makes illegal for poor and low skilled people (especially young workers) from being employed at all.

This deprived those workers of the much needed “step in the door” in the labor market, which would allow them to gain experience and increase their productivity and their wage.

For example, young black males unemployment rates in the US were the same as white males in the 1940s before minimum wage laws existed. From 1890 through 1930, every survey showed that black men had the same participation rate in the labor market, if not higher, than white men. But since minimum wage laws were instituted, young black male unemployment soared, reaching 35% today, 20 points above other ethnicities.

Worker’s Unions typically lobby politicians for higher minimum wage laws in an effort to eliminate their direct competitors (lower skilled workers) and increase their own wages at the expense of poor people.

6. Government spending helps the economy

One thing that is true, is that government spending helps GDP statistics looks better, since the government spending is counted as a direct contributor, on par with private spending.

However, this is an obvious flaw in the GDP statistics accounting, rather than a reflection on the real contribution of the government spending on the amount of goods produced in the economy.

Basically, the problem is that we can’t consider on the same level goods that are produced and paid for voluntarily by consumers, and services paid by the government with money taken from taxes.

For example, if a private citizen decides to spend 100$ on tickets for a trip to Disneyland, this tells something about the value of the service produced by the Disney Corporation in operating the attraction park.

That a bureaucrat decides to spend someone else’s money (the tax payer), to the extent of 389,357$ on a study of whether malt liquor should be used with or without marijuana says very little about the value of the service produced to society.

Government spending also does not help the economy in general, as soon as one consider the source of government spending – if someone claims that the government spending has “multiplier effect” in the economy (as do many economist trained as propagandist for the government), then when one realize that money spent by the government has first to be taken from producers in the private sector (either through taxes, inflation, or borrowing), this confiscation must also have a “divider effect” – which is not surprisingly never discussed when we hear about the alleged benefits of government stimulus spending.

In other words, if the government spends 100$, and those receiving it in turns spends it, and so on, then the persons that were taxed had also 100$ less to spend other other goods in the private sector, and so are the people who would have received the 100$, and so on.

And since government spending is worth much less, as we seen above, government spending is actual destroying wealth in the society.

An argument that I am not addressing here is the alleged ‘fall in aggregate demand’, which completely ignores the existence of prices.

5. We are better off today than 100 years ago because of technology

Technology (the knowledge of how natural resources can be transformed to satisfy ends) isn’t sufficient into producing the means to satisfy those ends.

For instance, the ancient Greeks had discovered the steam engine, yet it did not foster economic development as it did at the beginning of the industrial revolution.

Sub-Saharan Africa has access to all the knowledge and technology that the west uses, alas it remains poor.

This is because the knowledge isn’t enough, what is needed is the capital goods that make use of that knowledge. Without saving, it is not possible to accumulate capital goods, and without capital the population is reduced to use unproductive means of production.

Today, we are better off in the west because we have more goods, because we are more productive, thanks to the capital accumulation and the saving of the previous generations over decades and centuries.

As Ludwig von Mises explain, the essential institutional requirements for saving and capital accumulation are: liberty, private property, and sound money.

4. Poor countries are poor because they don’t have money

Poor countries are poor, mainly because their citizen are less productive than the citizen of western countries.

They are less productive because they use much less capital goods. For instance, the farmers in Africa do not use modern agricultural techniques, using tractors, fertilizers, and so on, because they lack the savings required to buy those capital goods, or because those capital goods are typically expropriated or destroyed before they can be put to profitable use.

Many poor countries have dysfunctional capital formation mainly because of lack of 1) private property rights 2) liberty to use one’s property, and 3) sound money.

Poor countries are plagued by governments that routinely violates their citizen’s property rights, through taxes, licenses, permits, tariffs, regulations, and outright expropriation, so that saving and investment is a futile exercise since the savings do not benefit the person abstaining from consuming his own income.

In fact, government that issue the most money typically impoverish their population the most (everyone is a billionaire in Zimbabwe).

3. High prices are caused by greedy businessmen

In spite of the desire from greedy businessmen to maximize their profit, competition on the free market by entrepreneurs leads to higher capital investment, higher productivity, higher production, and generally lower prices.

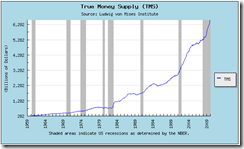

The ultimate cause of the increase in prices is the deliberate devaluation of the currencies, year after year, by increasing the quantity of money in the economy by the central bank.

In the US, for example, the quantity of money (M2) went from roughly 300 billions in 1960 to 8500 billions in 2009, while the value of the US dollar lost 86% of its purchasing power over the same period.

In other words, 100 dollar saved in 1960 will today only buy 14$ of goods – 86$ having been expropriated through the devaluation of the currency.

2. For someone to get rich, others have to get poor

It is true that, given a fixed stock of money, one cannot increase his cash holding without someone else having to reduce his own.

The major caveat being that money is not wealth in the aggregate sense, meaning that even though one person becomes wealthier by having a larger cash holding, all other things equal, having more money in the economy does not generate more wealth, it simply reduces the value of the existing money stock.

Fortunately there is many other ways of being wealthy, one being by owning capital goods.

For example, the stock of money can remain constant over time in a village, but if a farmer plough his land, accumulate live stock, dig a new well (i.e. he refrain from consuming all his income, and instead invest parts of it in improvement of his capital stock), he becomes wealthier without other villagers to having to get poor.

In fact, by being able to produce more agricultural goods, and exchanging them to the other villagers, the farmer makes everyone wealthier.

The same is true for modern entrepreneurs, as long as they operate strictly on the free market, and do not use privileges by the governments (subsidies, government contracts, tariffs, patents, licenses, grants, eminent domain benefits, regulations, etc..) to enrich themselves at the expense of others.

1. War, disasters and destruction cause economic prosperity

This is the classic broken window fallacy.

This idea claims that by destroying goods, the activity required to replace those goods will improve the conditions of everyone in the economy by promoting the circulation of money.

It goes without saying that the purpose of producing goods in the first place is to enjoy the services of the goods produced by this process. Toiling to produce goods is not something anyone wants to do for its own sake, and destroying the produced good simply to suffer the disutility of having to produce them again is nonsensical.

The problem arise when the production process is divided between different persons through the division of labor and voluntary exchange (the exchange economy). Once someone produces goods not for his own consumption but for someone else's, the problem for the producer of deciding which goods to produce that will satisfy other people’s needs arises, which didn’t exist when a single person was producing goods for his own consumption.

Basically, in an exchange economy, some people (called entrepreneurs) will take upon themselves to discover which goods should be produced, and coordinate the producers desire for an income, with the consumers spending intentions for those goods, through competition and the price system.

This is a task of coordination that will always exist in all economic organizations where there is a division of labor.

The fundamental error in the broken window fallacy is to completely ignore this coordination task, and assume that the glazier’s (see the link above) desire for an income can only be satisfied by destroying existing windows, since not enough demand exist without it for all the glaziers in the town.

In fact, the glazier would have to realize that demand for window repair services are satiated, and that his task is to discover (since he is small business owner, hence an entrepreneur) which goods consumers would like to be produced, so that he can reallocate his labor to the production of those goods, if he wants to remain involved in the exchange economy.

It is obvious then that the fallacy of destruction is a naïve attempt to find which goods needs to be produced: "If a good exist already, then it must be because there was a demand for it, so instead of discovering which goods needs to be produced, we can only destroy the existing goods, and the coordination problem will be resolved”. Needless to say, this solved the problem for the coordinator only, at the expense of the owner of the good.

As long as humans have needs that are not fully satisfied, and the freedom to satisfy those needs exist, employment through the division of labor will be possible.

If we ever reach the Garden of Eden, where all human needs are fulfilled, then we will not be able to find employment in the division of labor, but then we wouldn’t need a job nor an income either, since all our needs will be satisfied.

The fundamental truism remains that destruction destroys wealth, and makes the economy poorer than it would be otherwise. Destroying capital goods also makes the economy less productive, so is allocating capital goods to the production of goods that have been needlessly destroyed.

It is an indisputable fact that without the destruction having ever happen, the society would have been richer than it would be by re-producing destroyed goods.

That destruction causes prosperity is an old fallacy (Resurrected in modern times by J.M. Keynes), that originates from the ignorance of one fundamental insight of economics science (from Hazlitt):

To see the problem as a whole, and not in fragments: that is the goal of economic science

Understandably, most person reading this list will be unconvinced by few or many of the short description attempting to dispel the myths. Many “yes, but…” “you haven’t tough of…” and “this is wrong because…” should be heard in the average reader’s mind.

There is simply not enough space in a short blog post to give a comprehensive economics lesson.

If this list made your curious about learning more, a good start would be this book:

Also available for free online here.

Loch Ness picture from user Carla216 on Flicker, creative commons.