Off topic: I just got an mobile broadband USB stick from Orange in the UK, and their mac (and windows) software is truly awful.

Now, at least on Windows, they software succeed to connect to the internet, but on Mac (especially OS X 10.5), it fails without any error after clicking on 'Connect'.

But do not despair, there's a way to connect to the internet on the mac:

After having installed the "Orange Mobile Partner" software that came on the USB stick, and restarted the computer, go in the System Preferences 'Network' panel.

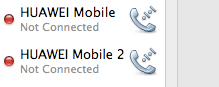

The following two network interface should be added automatically:

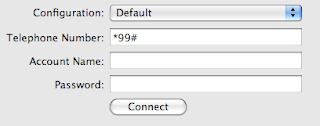

Now, click on the first interface (HUAWEI Mobile), and enter the following information:

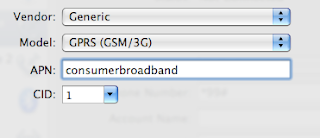

Click on the "Advanced..." button at the bottom of the panel, and enter the following settings:

Click "Ok", then "Apply" in the network panel.

You can now connect to the internet using the Orange mobile broadband with the standard Mac OS X software without having to open the awful "Orange Mobile Partner" software!