I read recently about the Khan Academy.

This academy consist of a person recording hundreds of youtube videos teaching different subjects, going from mathematics, chemistry, biology, history, and economics.

The teachings are short, 10 minute videos, targeted at explaining to the student and dilettante many scientific subjects.

Allegedly, up to 200 000 students are visiting the site each month.

I didn’t watch the other themes, and I assume they are fine, but the ones about economics are terribly bad.

It is doubtful if Mr. Khan even had a micro-economics class (since you don’t hear him talk about supply and demand basics), but it seems typical of the learned intellectual who seem to think that because he knows some scientific subject, he can just “think” about economics in his head, without learning systematically about the subject, and whatever seem to be “common sense” to him must be true.

For instance, for Mr. Khan, what causes inflation is (typical scapegoats) businessmen raising their prices. Why do businessmen raise their prices, according to Mr. Khan? Simply because they can, when there’s high utilization of the factors of productions (e.g, a factory producing at half capacity).

The fact that the US dollar lost 96% of its purchasing power over the last century is apparently simply due to greedy businessmen.

Not surprisingly, Mr Khan has no notion of money supply (money is simply a “unit”).

Mr. Khan analysis is one that statically look a a single company, or a set of a handful of companies, in a given year, and speculates (badly) on their hypothetical behavior without having any clue about what forces will lead to prices change in equilibrium.

Mr. Khan needs to read an introductory book (as this one, for example) about money, and learn that it is not businessmen that cause the general price level to rise, but the Federal Reserve that increase the money supply, year after year, and destroy the purchasing power of the monetary unit.

In fact, the truth is the opposite – businessmen, by their capital investment, cause an increase in productivity, which leads to higher production, and lower prices in general.

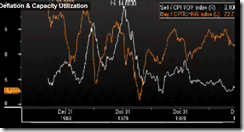

What does Mr. Khan shows as evidence of his theory? The following graph:

(sorry for the bad resolution, taken from his video)

The “capacity utilization” (I’m not sure what metric he uses) is in orange, while the price index is in white;.

Mr Khan pretends that the former (the capacity utilization) is cause of the later (the price index). So when one rises (capacity utilization), the other should raise as well (price index).

If there’s any example of confirmation bias, that is one.

At best, that graph shows that there’s no correlation between the two metrics (for some years, they raise in parallel, while other years, one raise while the other falls).

For the entire decade after 1990, prices fall while capacity utilization increases.

Worse, the graph fundamentally contradict Mr. Khan’s arguments, which is that “high capacity utilization” causes prices to rise, and low utilization causes prices to fall. Indeed, his graph shows the CPI change rate, which is the rate at which prices increase, not the price level itself.

Basically, his graph shows that the price level increase year after year, no matter is the capacity utilization is high or low. The price level never decrease for all the decades presented (the CPI change rate never go below 0%). So it doesn’t explain why prices increase at all, since they increase no matter what is the capacity utilization – and the rate doesn’t even correlate with the capacity utilization.

So in fact, this graph is the very refutation of his own argument.

Then, Mr. Khan even goes on to say that he was worried about hyperinflation because capacity utilization was getting too high at the end of last decade.

Why do Mr. Khan “common sense” fails? Because he incorrectly extrapolate from his single analysis of an isolated business (which is far from accurate) to the general economy: the fallacy of composition.

Mr. Khan does not explain why would capacity utilization fluctuate at large in the economy, how it could become “uncontrollably high” as to generate hyperinflation, nor why isn’t high capacity utilization naturally counterbalanced by increase in investment, rising of the interest rate, and decrease in consumption.

Nor, why would cycles of high and low “capacity utilization” would cause a sustained increase in prices? Why wouldn’t the prices go high and low, and overall remain stable over time?

Why would not the general increase in productivity over the years, and general increase in production cause a general fall in prices instead (more supply –> lower prices)?

Just basic econ 101 questions that Mr. Khan fails even to consider.

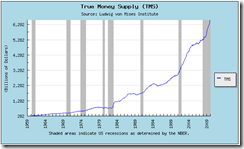

Maybe Mr. Khan should look at this graph instead, and he will maybe start to understand the main reason why prices increase, year after year:

http://mises.org/content/nofed/chart.aspx?series=TMS

Unfortunately, this is not all of Mr Khan’s pitfalls.

In Mr. Khan example, businessmen simply go purchasing luxury cars at the first sight of profit. The only thing they control is the asking prices of their goods, and ask high as they can mange to get. They are not investors, but behaves like spendthrift customers.

Mr Khan also shows the typically intellectual anti-business mentality, where in his example, for a company to be successful, they must deceive customers (by putting nicotine in their cupcakes) and gouge them arbitrarily (“increase prices when utilization is high”).

The problem is that, like most intellectuals, Mr. Khan would be a terrible businessman, who would go quickly out of business against better competitor if he was to behave as he portraits businessmen to behave in his examples.

Businessmen are not moron who can only tinker with prices (those who are are not in business for long) to maximize their profit rate. What they want is maximize their profit, no matter what is the rate they will have (better to have 10% on 2 millions $ than 50% on 50k $), and by forecasting their customers and competitors behaviors, they invest, expand, change, innovate accordingly.

In conclusion, that Mr. Khan is economically illiterate is not a problem, but that he remains in this state of ignorance and go teach students about his ideas is a danger to the progress of knowledge and the general welfare of society.